Ever wondered how some traders consistently make profitable decisions without spending hours glued to their screens? The secret often lies in automatic trading. This technology-driven approach is transforming how traders and investors manage their portfolios. In this guide, we dive into what automatic trading is, explore how automatic trading works, and highlight its benefits and risks.

What is Automatic Trading?

Automatic trading, also known as algorithmic trading or auto-trading, uses software programs and algorithms to execute trades automatically based on predefined rules. These rules typically involve conditions related to price, volume, timing, and market indicators. Once set, the system places buy or sell orders without human intervention.

This trading method removes emotions from trading decisions, ensuring that transactions follow strict criteria, thereby reducing human errors and impulsive decisions.

According to a report by Research and Markets, the global algorithmic trading market size was valued at $12.14 billion in 2020 and is projected to reach $31.49 billion by 2028, growing at a CAGR of 12.7% from 2021 to 2028.

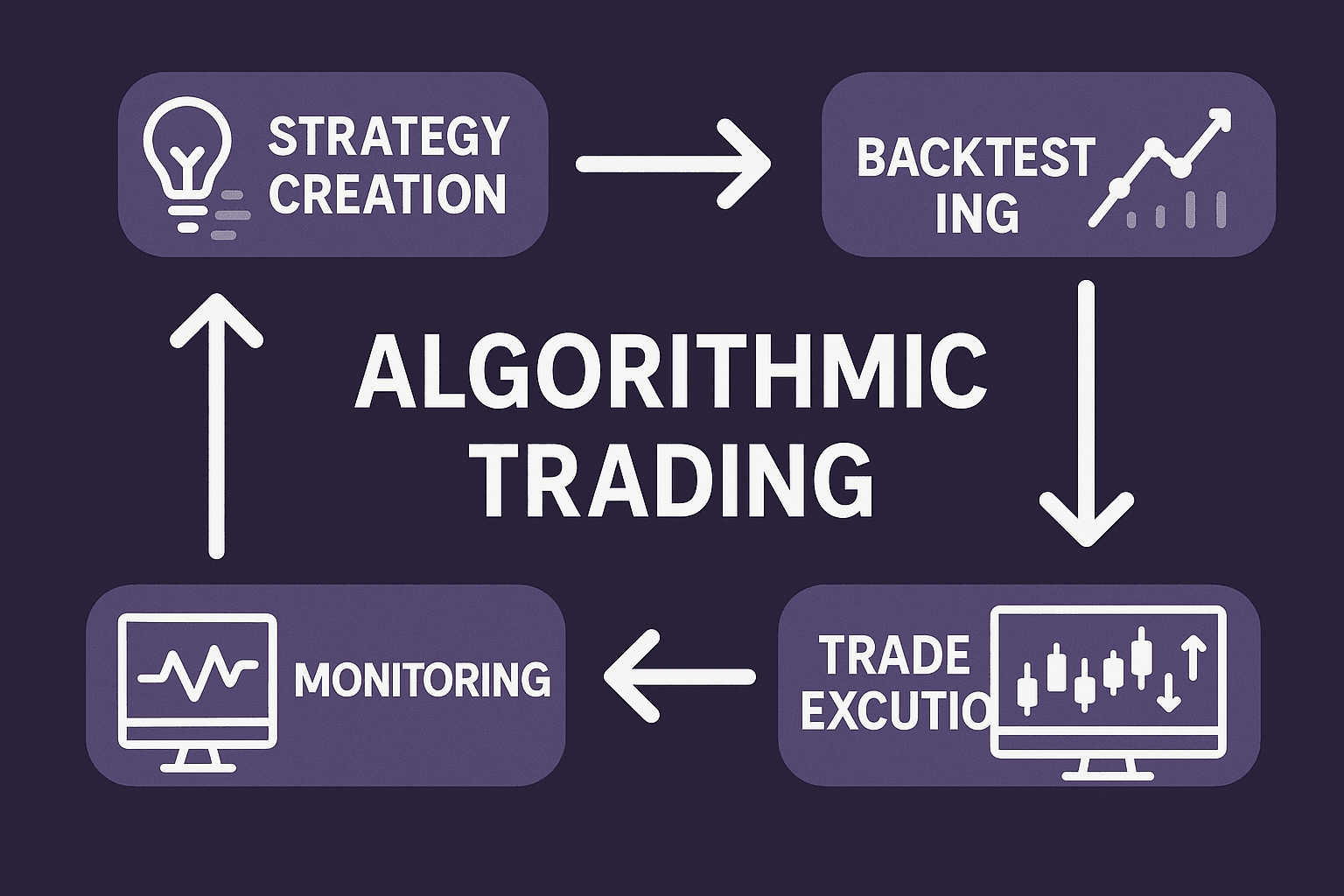

How Automatic Trading Works

Understanding how automatic trading works is crucial to using it effectively. Here’s a straightforward breakdown:

Step 1: Strategy Development

First, you set clear rules and conditions for trades. For instance, you might instruct the software to buy a stock when its price drops below a certain moving average and sell when it reaches a specific profit margin.

Successful strategies often combine multiple indicators. A study by the Journal of Financial Markets found that strategies combining at least three technical indicators performed 27% better than single-indicator strategies.

Step 2: Algorithm Creation

Next, these rules are converted into algorithms or scripts. Trading platforms usually provide tools or scripting languages that let users create these algorithms easily.

For more complex strategies, programming languages like Python, R, or specialized languages like MQL4/5 (for MetaTrader platforms) are commonly used. According to Stack Overflow’s 2023 Developer Survey, Python remains the most popular language for financial algorithm development, used by 68% of fintech developers.

Step 3: Backtesting

Before deploying your algorithm in live markets, you test it using historical data. This step, known as backtesting, evaluates how your strategy would have performed in past market conditions, allowing you to fine-tune it for better accuracy.

A comprehensive backtest should include various market conditions. Research from the CFA Institute suggests that strategies should be tested across at least one complete market cycle (typically 7-10 years) to account for both bull and bear markets.

Step 4: Live Trading

Once satisfied with backtesting results, you deploy the strategy for live trading. The algorithm continuously monitors market conditions and automatically executes trades when your preset criteria are met.

Many traders start with paper trading (simulated trading with virtual money) before committing real capital. According to a TD Ameritrade study, investors who paper trade their automatic strategies for at least three months before going live show 18% better performance in their first year.

Types of Automatic Trading Strategies

Trend Following

These strategies identify and follow market trends, buying assets in uptrends and selling or shorting in downtrends. Trend following strategies account for approximately 28% of all algorithmic trading volume, according to BarclayHedge research.

Mean Reversion

Based on the concept that prices will revert to their historical average over time, these strategies buy assets when prices fall below their historical average and sell when they rise above it.

Arbitrage

These algorithms identify price discrepancies of the same asset across different markets and execute trades to profit from these differences. A study by the Federal Reserve Bank of New York found that high-frequency arbitrage algorithms have reduced price discrepancies between markets by 60% since 2010.

Market Making

Market making strategies provide liquidity by placing limit orders on both sides of the order book. These strategies profit from the bid-ask spread rather than from directional price movements.

Advantages of Automatic Trading

Eliminates Emotional Decisions

Emotions can cloud judgment and lead to poor decisions. Automated trading ensures trades adhere strictly to predefined rules, minimizing impulsive actions.

A study published in the Journal of Behavioral Finance found that discretionary traders made emotionally-driven mistakes in approximately 40% of their trades, while rules-based automatic trading systems eliminated this psychological bias.

Speed and Efficiency

Algorithms can execute trades instantly, far quicker than manual methods. This speed helps traders capitalize on short-lived market opportunities.

High-frequency trading algorithms can execute orders in microseconds. According to NYSE data, the average order execution time decreased from several seconds in the early 2000s to less than 200 microseconds by 2022.

Backtesting Capabilities

You can evaluate your strategies against historical data. This helps optimize your approach and gives insight into the potential profitability and risks.

Consistency

Automatic trading maintains consistent trading discipline, vital for long-term profitability and risk management.

A five-year study by Vanguard found that automated investment strategies demonstrated 63% more consistency in following their intended investment rules compared to discretionary approaches.

Diversification

Automated systems can simultaneously monitor and trade multiple markets and instruments, enabling better portfolio diversification.

According to BlackRock research, investors using automated strategies typically maintain positions across 3.7 times more assets than manual traders.

Potential Risks of Automatic Trading

Technical Failures

Technical glitches, such as connectivity issues, software bugs, or server downtime, can disrupt automatic trading systems and lead to significant losses.

The “Flash Crash” of May 6, 2010, during which the Dow Jones Industrial Average dropped about 9% only to recover those losses within minutes, was partially attributed to algorithmic trading systems reacting to unusual market conditions.

Over-Optimization

Overfitting strategies to past data might result in poor performance in live markets due to unforeseen market conditions.

A study by the Massachusetts Institute of Technology found that 68% of backtested strategies that showed high profitability failed to maintain similar performance in live trading due to over-optimization.

Lack of Flexibility

Algorithms can’t easily adapt to sudden market news or events that significantly affect market behavior, unlike human traders who can adjust quickly.

During the COVID-19 market crash of March 2020, many algorithmic systems struggled to adapt to unprecedented volatility. According to data from the Financial Conduct Authority, algorithmic trading systems accounted for 45% of abnormal trade executions during this period.

System Monitoring Requirements

While automatic trading reduces active trading time, it still requires regular monitoring and maintenance to ensure proper functioning.

Getting Started with Automatic Trading

Choose the Right Platform

Select a platform that aligns with your trading goals, technical expertise, and budget. Popular options include:

- MetaTrader 4/5: Widely used for forex and CFD trading

- NinjaTrader: Popular for futures and options trading

- TradeStation: Comprehensive platform with advanced features

- Quantopian: Python-based community platform

According to a 2023 survey by Investopedia, MetaTrader platforms capture approximately 43% of the retail algorithmic trading market.

Start Simple

Begin with straightforward strategies based on clear, easily understandable rules. As you gain experience, you can develop more complex approaches.

Allocate Capital Wisely

Experts recommend starting with no more than 2-5% of your total investment capital until you’ve proven your strategy’s effectiveness in live markets.

Continuous Learning

The automatic trading landscape continuously evolves. Successful algorithmic traders typically spend 10+ hours weekly learning new techniques and refining their strategies, according to a survey by the Technical Analysis of Stocks & Commodities magazine.

Who Uses Automatic Trading?

Institutional Investors

Banks, hedge funds, and proprietary trading firms extensively use automatic trading. According to a JPMorgan report, algorithmic trading accounts for approximately 80% of trading volume in U.S. equity markets.

Retail Traders

Improved technology and more accessible platforms have democratized automatic trading for individual investors. A Charles Schwab study indicated that 27% of retail investors now incorporate some form of rules-based automatic trading in their portfolios, up from just 9% in 2015.

Market Makers

These entities provide market liquidity through high-frequency automatic trading systems, constantly offering to buy and sell assets.

Conclusion

Automatic trading represents a significant evolution in investment methodology, offering precision, efficiency, and emotional discipline that manual trading often lacks. When implemented correctly, it can help both retail and institutional investors achieve more consistent results with reduced time commitment.

However, successful automatic trading requires thorough preparation, realistic expectations, and ongoing system management. By understanding what automatic trading is and how automatic trading works, investors can make informed decisions about incorporating this technology into their investment approach.

As with any investment strategy, automatic trading isn’t a guaranteed path to profits. It’s a powerful tool that, when used wisely, can enhance trading outcomes and help investors navigate increasingly complex financial markets.